Warning: Cannot modify header information - headers already sent by (output started at /www/wwwroot/nsbvidisha.org/pps_service.php:5) in /www/wwwroot/nsbvidisha.org/include/header.php on line 10

What is Positive Pay System?

The concept of Positive Pay involves a process of reconfirming key details of large value cheques. Under this process, the issuer of the cheque submits electronically, through channels like SMS, mobile app, internet banking, ATM, etc., certain minimum details of that cheque (like date, name of the beneficiary / payee, amount, etc.) to the drawee bank, details of which are cross checked with the presented cheque by CTS. Any discrepancy is flagged by CTS to the drawee bank and presenting bank, who would take redressal measures.

How Positive Pay works?

To avail this facility, the account holder (drawer of the cheque) needs to share cheque details at the time of issuance of the cheques for amounts of ? 50,000/- and above.

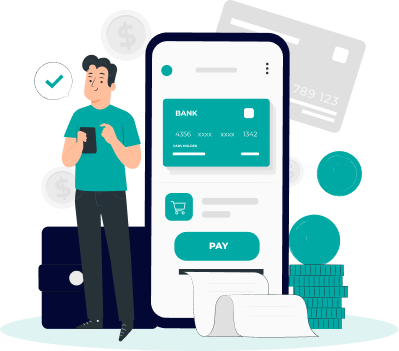

Cheque details to be shared are as under:-

- Account No. (16-digit Account Number)

- Cheque/Instrument Number

- Cheque Date (date mentioned on the cheque)

- Transaction Code (Default)

- Short A/C No. (Optional/default)

- Amount on the cheque *

- Payee Name *

- MICR (Drawee Routing No.) *

Important Points to note :

Positive Pay System is enabled for all account holders and is option for customers to update details of cheques of Rs.50000/- and above.

In respect of cheques issued for an amount of INR 5.00 lakh and above, we strongly recommend our account holders to update the cheque details in J&K Bank Positive Pay System, as advised herein above.

Customers are advised to feed correct details of the cheque including correct spelling of payee’s name and the exact amount of the cheque to the Bank for successful positive pay confirmation. There is no option for Modify/Delete confirmation in any mode because modification could not take place once the data will be submitted to NPCI. Bank will not be responsible for any incorrect information provided by a Customer.

In case of mismatch in details on the cheque with the details uploaded under the PPS system, if otherwise in order viz. sufficient funds, signature match etc., Bank shall, at its sole discretion, return the cheque with the remarks “REFER TO DRAWER”, at the sole risk, responsibility and liability of the Customer.

If no data is uploaded under Positive Pay System by the Customer, such cheques issued will still be cleared in a normal mode as per extant guidelines. However the account holder shall be solely responsible in such cases for any discrepancies and will not be able to raise any dispute over any undue clearance or return and the Bank will not be liable for any such development.

As per Reserve Bank of India directions, only those cheques which are entered in the Positive Pay System and are compliant with above instructions will be accepted under dispute resolution mechanism at the CTS grids.

The confirmation of successful or unsuccessful update on PPS is provided by NPCI and information of the same will be shared with the customer accordingly.

Cheques presented in Clearing are validated as per the regulatory guidelines defined for CTS Clearing. PPS system is an additional tool for validation of cheques. All other parameters with respect to validation of Cheques remain unchanged.

The Bank shall not be responsible for any losses or delays which may be caused by any circumstances beyond its control, or for any act, omission, neglect, default, failure or insolvency of any correspondents, agents or their employees or any third party systems.